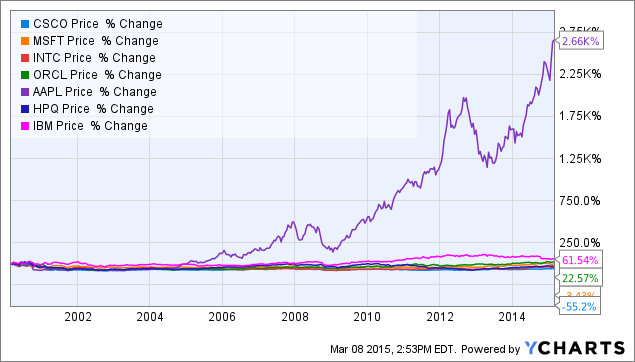

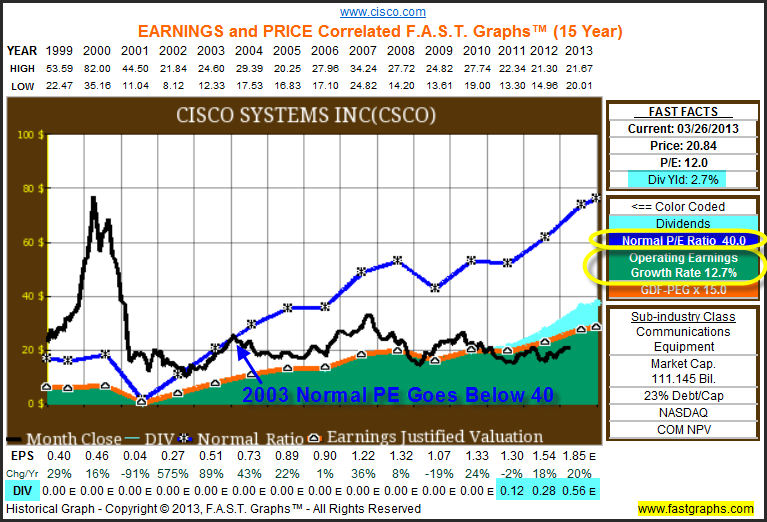

Looking For Value, Growth And Income After The Recent Market Run Up, Check Out These Tech Titans - Business2Community

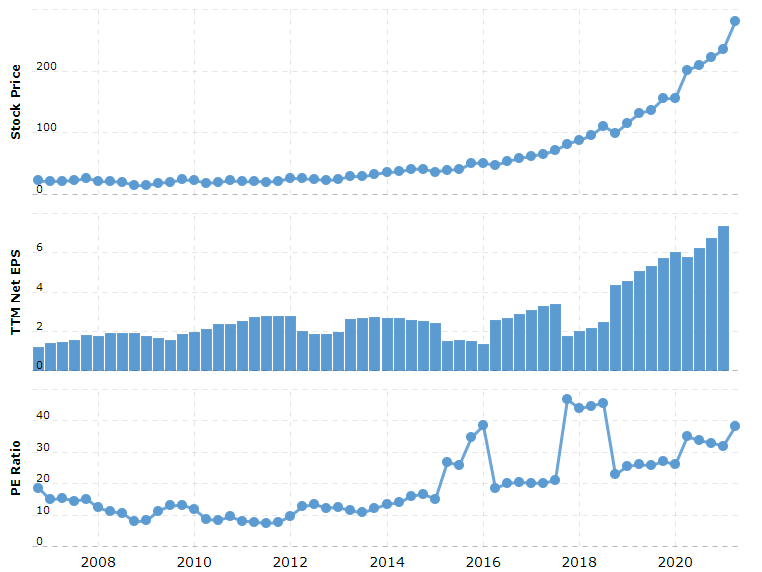

Charlie Bilello on X: "Apple's P/E Ratio: 29x 10-year average: 20x Apple's EV/EBITDA Ratio: 22x 10-year average: 14x Apple's Price to Sales Ratio: 7.3x 10-year average: 4.7x $AAPL https://t.co/uDCZANw6XV" / X

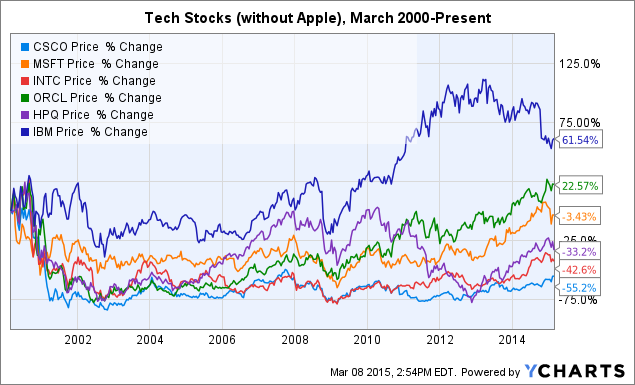

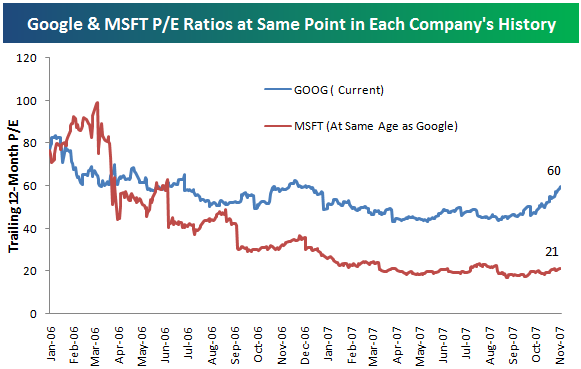

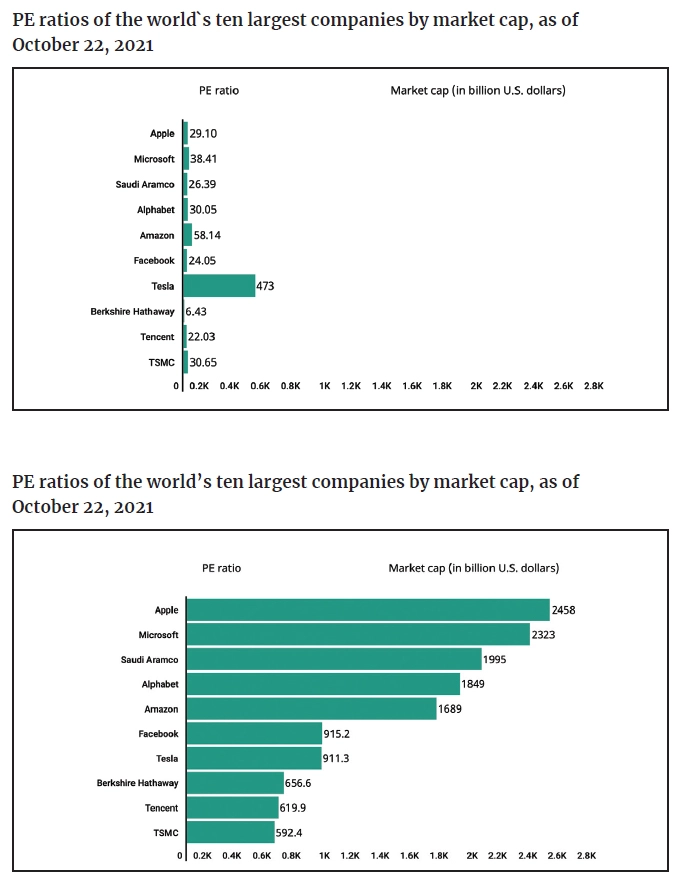

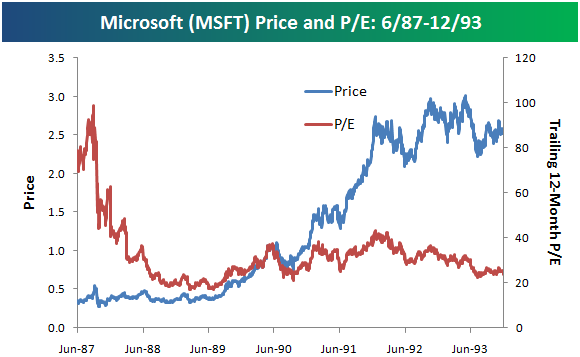

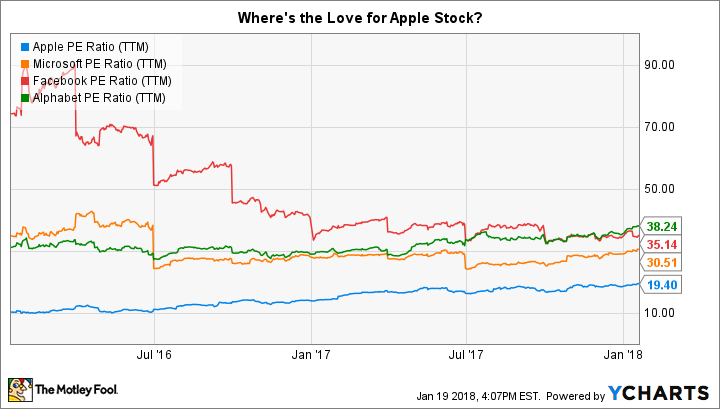

The Real Reason Apple Inc. Is So Cheap Compared to Alphabet Inc, Facebook Inc, and Microsoft Corporation